B6 CAPITAL ALLOWANCES A1. 8 Oktober 2018 INLAND REVENUE BOARD OF MALAYSIA _____ Page 2 of 19 43 The conditions that must be fulfilled by a person to qualify for an initial allowance IA and an annual allowance AA are the same as the conditions to claim capital allowances at the normal rate under Schedule.

Higher Education In Saudi Arabia Malaysia International Scholarship The Malaysia International Scholarship Mis Is An Initiative By The Malaysian Government To Attract The Best Brain From Around The World To Pursue Advanced Academic

122018 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

. On 30 August 2017 two orders PUA 2522017 and PU A 2532017 that are effective as from year of assessment 2015 were published in Malaysias federal gazette to provide incentives to qualifying companies that are incorporated and resident in Malaysia and that have incurred qualifying capital expenditure relating to automation equipment used in. Type of Asset Initial Allowance Rate Annual Allowance Rate Heavy machinery and motor vehicles 20 20 Plant and machinery general 20 14 Others 20 10. Many taxpayers are unaware that this form of tax deduction could lead to their companys efficient tax management.

Examples of assets that are used in business are motor vehicles machines office equipments furniture etc. Standard rates With effect from YA 2000 cyb capital allowances are re-categorised into three classes and the rates of capital allowances are revised as follows. Small value assets with values not exceeding RM 2000 are eligible for 100 capital allowance.

12 September 2018 _____ Page 2 of 27 4. The ACA Rules was gazetted on 5. Capital Allowances study is important to ensure the amount of claims is made correctly.

Accumulated losses capital allowances up to YA 2018 can be carried forward up to YA 2025 b Unabsorbed pioneer losses and unutilised. Your companys capital allowance schedule is as follows. Capital allowance tax depreciation on industrial buildings plant and machinery is available at prescribed rates for all types of businesses.

General rates for the allowance of industrial buildings are 10 initial allowance and 3 annual allowance. Claims for capital allowance can be made in. Conversely a balance allowance deductible item GLOBAL GUIDE TO MA TAX.

Please read this with care so that ment 2018 are true complete and correct. Tax Leader PwC Malaysia 60 3 2173 1469. Initial allowance is granted in the year the expenditure is incurred and the asset is in use for the purpose of the business.

A balancing charge taxable item arises where the sales proceeds for the asset exceed its tax residual value. 72018 Date Of Publication. Capital allowance is only given to business activity.

However the total capital allowance of all small-value items is capped at RM 20000. While annual allowance is a flat rate given every year based on the original cost of the asset. 16 MARCH 2020.

The person who has the right to claim capital allowance is the person who has expended on the purchase or acquisition of the said asset. Deductions accelerated capital allowances double deductions reinvestment allowances ie. Find out information on capital allowance CA such as who can claim CA as well as how to claim and calculate CA.

Often overlooked are proper claims of capital allowances on plant and machinery present in a building structure such as fire alarm and. Finance Bill 2018 Income Tax Amendment Bill 2018 and Labuan Business Activity Tax Amendment Bill 2018 Highlights. Capital Allowance 25 11.

This workshop focuses on providing an overview of the capital allowances regime and the rules governing tax deductions in Malaysia. Capital allowances have been claimed on the acquired asset. In completing the Form B for Year of Assessment 2018.

It is allowed in the form of capital allowance which is deductible from the adjusted business partnership. Malaysia Taxation and Investment 2018 Updated April 2018 1 10 Investment climate 11 Business environment Malaysia is a federated constitutional monarchy with a bicameral federal parliament consisting of an. The rules on making capital allowance claims have changed significantly in recent years and have become increasingly complex.

Description Machine Cost. If not a citizen of Malaysia please refer to. YA 2017 AA.

Capital Allowance - Rates A Before Janauary 01 2014 B As of January 01 2014. Case laws and salient points in the IRBs Public Rulings will also be shared during. The threshold for purchased cars is changing from April 2018 cars will only qualify for the 100 first-year capital allowance if their CO2 output per kilometre driven is below 50gkm.

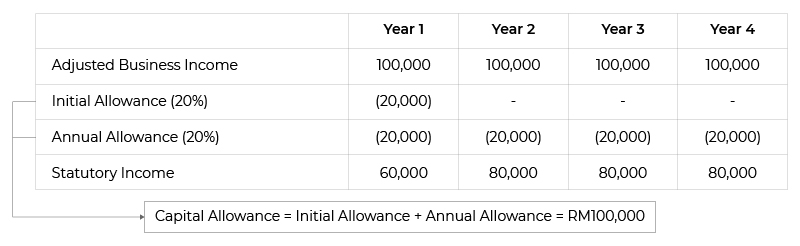

INLAND REVENUE BOARD OF MALAYSIA QUALIFYING EXPENDITURE AND COMPUTATION OF INDUSTRIAL BUILDING ALLOWANCES Public Ruling No. Industrial Building Allowance 28 12. The ACA Rules allows for an accelerated CA to be fully claimed in four years by a resident in Malaysia based on initial allowance of 20 and annual allowance of 20.

KPMG in Malaysia 20 November 2018. Finance released the Income Tax Accelerated Capital Allowance Information and Communication Technology Equipment Rules 2018 the ACA Rules. The contents of the new gazette order the Income Tax Accelerated Capital Allowance Information and Communication Technology Equipment Rules 2018 2018 Rules are very much similar to the earlier Income Tax Accelerated Capital Allowance Information and Communication Technology Equipment Rules 2014 2014 Rules.

The capital allowance can either be calculated using the. It defers its claim for capital allowances in YAs 2017 and 2019 and only makes a claim in YAs 2018 2020 and 2021. Capital Allowance - Tourism Sector.

Citizen Enter MY for citizen of Malaysia. The emissions threshold for the main rate allowance is also changing. Replacement Cost of Furnishings 28 13.

New and used cars with CO2 emissions above 130gkm can claim special rate allowance of 8. Letting of Part of Building Used in the Business 28. 19 December 2018 Example 2 Wahida owns a 4-storey building consisting of 32 units that can be used as.

YA 2021 plant is defined to mean an apparatus used by a person for carrying on his business but does not include a building an intangible asset or any asset used and functions as a place. Qualifying Building Expenditure QBE is capital expenditure incurred by a person on the cost of. - cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc.

Capital allowance can be claimed from YA 2019 2017 2018 2018 Only cost incurred from YA 2018 is a qualifying expenditure. Get The Facts On Capital Allowance. Director General of Inland Revenue Inland Revenue Board of Malaysia DATE OF ISSUE.

Capital allowance can be claimed from YA 2018. The annual allowance is given for each year until the capital expenditure has been fully written off unless. A the amount of the capital expenditure incurred on the construction of the building reduced by the aggregate amount of all annual allowances which if the building from the time of its construction by a person to the date of its purchase by the purchaser had been owned by that person and had been in use as an industrial.

32018 Date Of Publicaton. Qualifying expenditure QE QE includes. Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred.

Corporate Tax Planning In Malaysia Tax Options Tax Position

Slide 7b Industrial Building Allowance Pptx Taxation Industrial Building Allowances Qualifying Building Expenditure Qualifying Building Expenditure Course Hero

Pdf Small And Medium Sized Enterprises And Tax Compliance Burden In Malaysia Issues And Challenges For Tax Administration

Photo Taken At Kuala Lumpur International Sepang Kul Wmkk In Malaysia On January 12 2013 Air Asia Airbus Aviation

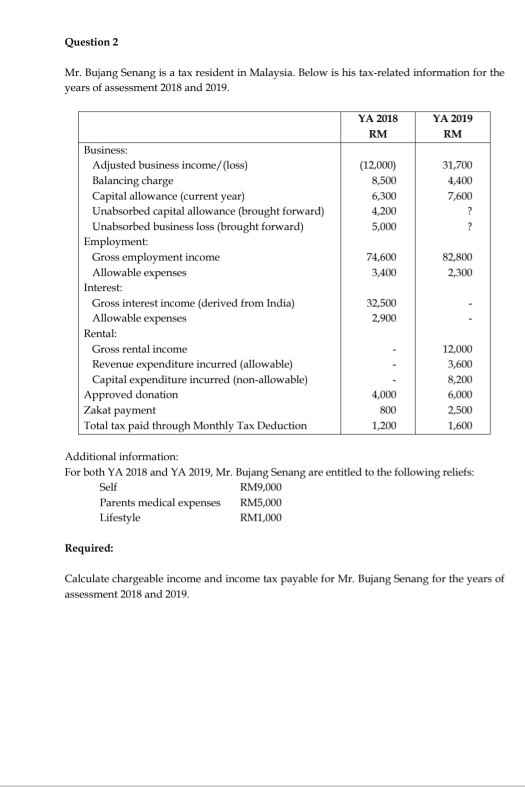

Question 2 Mr Bujang Senang Is A Tax Resident In Chegg Com

Malaysia S 2018 Budget Salient Features Asean Business News

Pdf Small And Medium Sized Enterprises And Tax Compliance Burden In Malaysia Issues And Challenges For Tax Administration

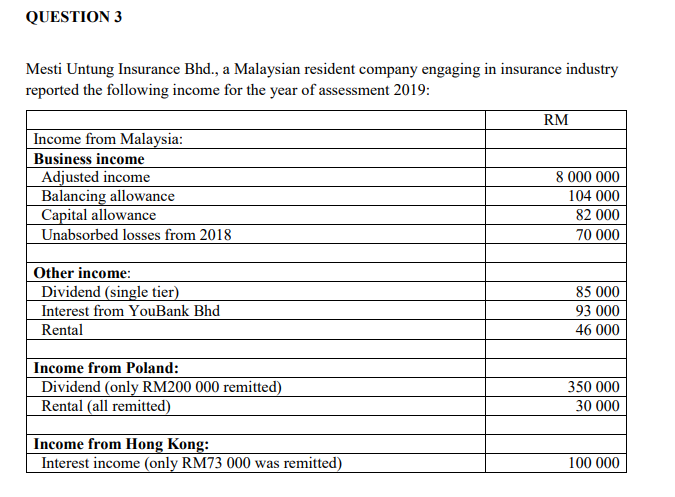

Question 3 Mesti Untung Insurance Bhd A Malaysian Chegg Com

Capital Allowance Calculation Malaysia With Examples Sql Account

Pdf Small And Medium Sized Enterprises And Tax Compliance Burden In Malaysia Issues And Challenges For Tax Administration

Corporate Income Tax In Malaysia Acclime Malaysia

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Budget 2019 The Proposed Tax Changes That The Business Must Know Cheng Co Group

Capital Allowance Calculation Malaysia With Examples Sql Account

Apply For Instant Cash Loan Personal Loans Dearness Allowance Cash Loans

Laws Of Malaysia Income Tax Regulations